Will I have to spend a lot of money making my commercial properties “energy efficient” and bringing them up to scratch?

The Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015 (“MEES Regulations”) are intended to improve the energy efficiency of residential and commercial privately rented properties.

For commercial property, it is Part 3 of the MEES Regulations which is important, which prohibit a landlord from granting new leases from 1 April 2018 or continuing existing leases from 1 April 2023, if that property does not meet certain minimum energy efficiency standards.

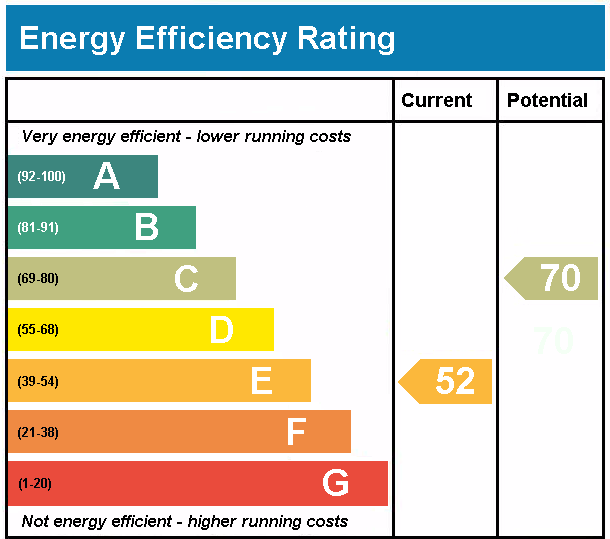

MEES is an abbreviation of “minimum energy efficiency standard” and is measured by the energy performance certificate (EPC) rating for the property. Currently, ratings F and G are deemed sub-standard but it is widely expected that the standards will increase over time.

As always, there are exceptions and excuses which are either: that all the relevant energy efficiency improvements for the property have been made already (even though the property is still sub-standard) or an exemption applies. To rely on one of these, the landlord has to submit its excuse or exemption by entering it into the Private Rented Sector (PRS) Exemptions Register to avoid enforcement action.

The exemptions:

• If a landlord needs consent from the tenant or (in some cases) a third party to carry out the works and that consent has been refused or has been granted subject to a condition with which the landlord cannot reasonably comply.

• The landlord has a report from an independent surveyor confirming that the relevant energy efficiency improvement would reduce the market value of the property by more than 5%.

• Various temporary exemptions such as where the landlord bought the property when it was already let, the prohibition “continuing to let a sub-standard property” is postponed for six months.

• All the relevant energy efficiency improvements have already been made but the property is still sub-standard.

Exemptions cannot be passed on from the landlord who registered the exemption to its successor as landlord.

Some types of energy efficiency improvements cannot qualify as relevant energy efficiency improvements and this needs to be considered when working out whether all the relevant energy efficiency improvements have been made. Such as:

•It is not one of the types of improvement specified by the regulations.

•The seven-year payback test is not satisfied – roughly: the anticipated savings on energy bills that over a period of seven years is less than the cost of the work. A landlord must register this on the PRS Exemptions Register and also provide evidence by way of 3 quotes from “qualified installers” to show the capital and installation costs along with the calculations re expected savings.

A landlord who does not comply with Part 3 of the MEES Regulations could find that:

• the property value decreases because potential purchasers are either put off or factor in the cost of doing the works needed to make it lettable under the MEES Regulations.

• tenants are not willing to pay a good rent for a property with lower energy efficiency than other properties in the locality.

Part 3 of the MEES Regulations does not impose a positive obligation on landlords to carry out works but a landlord who chooses to let the property or continue an existing letting without making the improvements without validly registering a good reaso

n or exemption on the PRS Exemptions Register, will run the risk of enforcement action. Currently, the maximum financial penalty for breach of the MEES Regulations varies depending on the type of property and the length of the breach leading to a hefty penalty of up to £150,000 for letting a sub-standard property for at least 3 months.

If you have any queries concerning this or any other matter please contact Laura Sainsbury, Senior Associate in our Commercial Property Team on 020 8567 3477 or e-mail lsainsbury@prince-evans.co.uk